Market Integrity Update - Issue 66 - November 2015

Edition 66, November 2015

Contents

Liquidity segmentation in equity markets

Small and fleeting orders in the SPI

Financial information in prospectuses

ASIC updates its fundraising guidance

ASIC market integrity rules for the Chi-X investment product market

Commencement date for OTC obligations extended

ASIC Insights: Investment managers and superannuation

ASIC cancels retail derivative issuer's licence

Liquidity segmentation in equity markets

Report 452 Review of high-frequency trading and dark liquidity (REP 452) published in late-October considered the issue of liquidity segmentation. Liquidity segmentation occurs where an exchange market or crossing system operator enables differentiated order execution priority (or other treatment) based on the user or type of user.

Report 452 Review of high-frequency trading and dark liquidity (REP 452) published in late-October considered the issue of liquidity segmentation. Liquidity segmentation occurs where an exchange market or crossing system operator enables differentiated order execution priority (or other treatment) based on the user or type of user.

Proposals have been presented to ASIC which seek to discriminate based on, for example, whether the user is considered 'professional' or a 'high-frequency trader', or where a market participant seeks to match with other orders it has submitted. Preferencing in this way could undermine fair and non-discriminatory secondary trading, set an undesirable precedent in our market for the interpretation of fairness obligations and create unnecessary complexity.

For these reasons, we are unlikely to support any form of liquidity segmentation on exchange markets or crossing systems that unduly favours some users over others, unfairly limits access to the facilities, or otherwise results in the unfair treatment of orders or users.

We will be closely monitoring existing broker preferencing arrangements on exchange markets. As part of this, we will review whether the ‘preference and/or kill’ feature of these order types needs to be wound back in order for market operators to more fully meet their fairness obligations.

For market participants that operate crossing systems, we recognise that some level of client profiling may be appropriate to fulfil client instructions. However, crossing system operators, as with exchange operators, should not systematically disadvantage some users over others.

Background

REP 452 was the result of two new reviews, which build on ASIC's 2012 analysis of equity markets, and assess the impact of high-frequency trading on our futures exchange markets.

Small and fleeting orders in the SPI

Some people have expressed concerns to ASIC that high-frequency traders do not provide 'real' liquidity, because their orders are small and fleeting – that is, they do not rest in the market for any meaningful period of time – and are largely inaccessible and potentially manipulative.

Some people have expressed concerns to ASIC that high-frequency traders do not provide 'real' liquidity, because their orders are small and fleeting – that is, they do not rest in the market for any meaningful period of time – and are largely inaccessible and potentially manipulative.

In REP 452, we found that these types of orders are not prolific in the equity and bond markets, where they represent 0.7% and 0.5% of orders, respectively. However, they comprise a much larger proportion of orders in the S&P/ASX 200 Index Futures Contract (SPI) futures market.

Five percent of all SPI orders were for one contract only and rested for a period of less than half a second for the day trading session (10% for the night session). Nearly half of the small and fleeting SPI orders during the day session were submitted by high-frequency traders (81% for the night session).

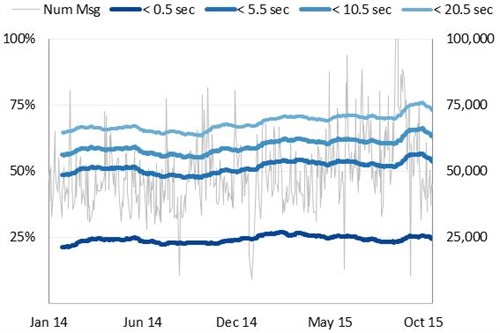

There is also a broader trend in the SPI for orders to be submitted for relatively short periods. Over the past year the proportion of all orders (of any size) that were amended before completion within a time frame of half a second or less was 24%: see Figure 1. This figure was 64% for orders that rested for less than 11 seconds (which has grown by 13% over the year).

Figure 1

Arbitrage trading between the SPI and the underlying cash market is a significant part of this market, so it is not unexpected that there are considerable amendments to SPI orders to reflect adjustments to prices. However, fleeting orders do have the potential to affect reactions in both the futures and, at times, the underlying cash market. Participants must give due regard to the submission of any order into a market.

Arbitrage trading between the SPI and the underlying cash market is a significant part of this market, so it is not unexpected that there are considerable amendments to SPI orders to reflect adjustments to prices. However, fleeting orders do have the potential to affect reactions in both the futures and, at times, the underlying cash market. Participants must give due regard to the submission of any order into a market.

Automated strategies should be adequately monitored to ensure that their behaviour fully reflects their designed intentions. All market users must ensure that their conduct does not create a false or misleading appearance of trading and that orders are not being entered without an intention to trade: see Rules 3.1.2 and 3.1.3 of ASIC Market Integrity Rules (ASX 24 Market) 2010.

Financial information in prospectuses

ASIC will closely scrutinise prospectuses which do not include two-and-a-half to three years of audited financial information, where the business has ‘relevant’ operating history.

ASIC will closely scrutinise prospectuses which do not include two-and-a-half to three years of audited financial information, where the business has ‘relevant’ operating history.

We recently published Report 446 ASIC regulation of corporate finance: January to June 2015 (REP 446). One of the issues discussed in this report is the quality and quantity of historical financial information provided to prospective investors.

A significant proportion of the offers we review contain very limited historical financial information, even though the underlying business has traded for a reasonable period of time. Some prospectuses contain only partially audited or unaudited financial information, suggesting that there has been little independent verification of this information.

It is difficult for investors to make an informed decision about an offer without sufficient reliable financial information.

Issuers and their advisers need to consider the extent and verification of the financial information which will be provided to investors well before a prospectus is lodged with ASIC. The failure to do this increases the risk that an offer will be delayed or prevented due to ASIC extending the exposure period or placing a stop order on the prospectus.

ASIC updates its fundraising guidance

ASIC is consulting on a proposal to update our Ch 6D fundraising guidance by issuing a draft regulatory guide. This and other proposals relating to securities offers are set out in Consultation Paper 239 Disclosure documents: Update to ASIC instruments and guidance (CP 239).

ASIC is consulting on a proposal to update our Ch 6D fundraising guidance by issuing a draft regulatory guide. This and other proposals relating to securities offers are set out in Consultation Paper 239 Disclosure documents: Update to ASIC instruments and guidance (CP 239).

The draft RG consolidates existing regulatory guidance into a single document examining the procedure for offering securities for issue or sale under a prospectus. We think that this will make it easier for issuers and their advisers to understand the processes involved in public fundraising.

For instance, the draft RG describes when we will extend the exposure period for a prospectus. It confirms that, apart from extensions to take into account public holidays, ASIC's practice is to extend exposure periods for seven days rather than a shorter period.

CP 239 also seeks feedback on proposals to issue legislative instruments to ensure that the law continues to operate efficiently and effectively in relation to securities fundraising.

The deadline for submission on CP 239 is 27 November 2015.

ASIC market integrity rules for the Chi-X investment product market

ASIC has published amendments to ASIC market integrity rules to ensure warrants and exchange traded funds (ETFs) admitted to quotation on Chi-X Australia Pty Ltd (Chi-X)’s new investment product market, are subject to an appropriate regulatory regime.

ASIC has published amendments to ASIC market integrity rules to ensure warrants and exchange traded funds (ETFs) admitted to quotation on Chi-X Australia Pty Ltd (Chi-X)’s new investment product market, are subject to an appropriate regulatory regime.

Chi-X is aiming to launch its investment product market in late-2015, commencing with the quotation and trading of warrants, followed by the launch of ETFs in 2016.

The amended market integrity rules apply to participants (and their representatives) who trade on the Chi-X investment product market, and include:

- in the ASIC Market Integrity Rules (Chi-X Australia Market) 2011 and ASIC Market Integrity Rules (ASX Market) 2010, that:

- individuals providing advice to retail clients on warrants quoted and traded on Chi-X must be authorised as accredited derivatives advisers (ADAs)

- participants must provide retail clients with Chi-X's explanatory booklet about warrants prior to purchasing a warrant on the Chi-X market for the first time, and enter into a written agreement with clients prior to their purchase of a warrant on either the Chi-X or ASX market for the first time

- participants must inform clients in writing about any material changes to their third-party execution and/or clearing arrangements resulting from their participation in the Chi-X investment product market, and

- there are mutual recognition rules in place in the Chi-X and ASX market integrity rulebooks for the ADA and client agreement obligations for warrants to minimise regulatory duplication, and

- in the ASIC Market Integrity Rules (Competition in Exchange Markets) 2011, that:

- existing obligations (including regulatory data obligations) that apply to financial products that are admitted to quotation on the ASX market will also apply when these products are admitted to quotation on the Chi-X investment product market.

Commencement date for OTC obligations extended

The commencement of the final phase of the OTC trade reporting obligations has been extended to 4 December 2015. This change affects financial entities with an OTC derivatives book size below $5 billion gross notional outstanding (Phase 3B entities).

The commencement of the final phase of the OTC trade reporting obligations has been extended to 4 December 2015. This change affects financial entities with an OTC derivatives book size below $5 billion gross notional outstanding (Phase 3B entities).

The ASIC Derivative Transaction Rules (Reporting) 2013 set out requirements for financial entities to report derivative transactions and positions to derivative trade repositories. Phase 3B was due to commence on 12 October 2015 for Phase 3B entities.

The additional time should provide entities sufficient time to put in place arrangements to start reporting. Phase 3B firms who wish to may commence reporting before 4 December 2015.

The delayed commencement to phase 3B follows an earlier 12-month delay granted by ASIC, and the introduction of delegated reporting and single-sided reporting options to enable a range of different models to meet the obligation.

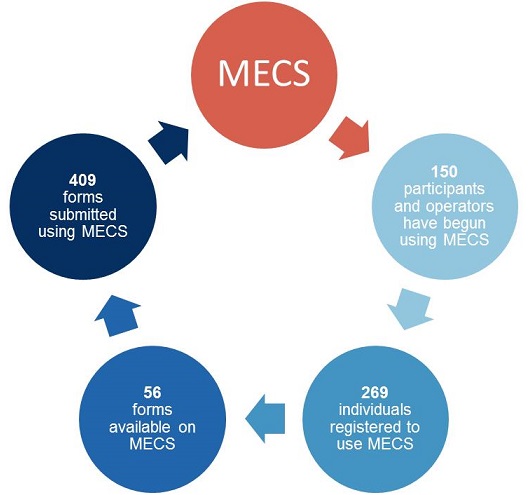

Recent MECS upgrades

ASIC has introduced new features and improved the functionality to the Market Entity Compliance System (MECS).

ASIC has introduced new features and improved the functionality to the Market Entity Compliance System (MECS).

These upgrades allow MECS users to:

- request that any notices served by ASIC be restricted to a single MECS user

- provide multiple responses to any notices served by ASIC – for example, if supplementary information is required after the initial response is submitted

- attach larger files to their submissions – up to 30MB per document (up from 20MB)

- search all text-based fields in MECS, including activities, forms and correspondence managed through MECS, and

- respond to questionnaires that ASIC may post on MECS.

Security enhancements have also been installed as part of the upgrade. As a result, all current MECS users will be sent an email with a new randomly generated secure password, which they will be prompted to update the next time that they log into MECS.

Information about the new features is available in the ASIC Market Entity Compliance System (MECS) user guide, which is located under the 'Resources' tab of the MECS homepage. MECS users can also contact their ASIC Relationship Manager if they have any other questions regarding these changes.

ASIC Insights: Investment managers and superannuation

ASIC has launched a seminar series for investment managers and superannuation industry representatives. 'ASIC Insights' will provide information about key issues and regulatory developments across these sectors and give attendees an opportunity to ask questions of senior staff from our Investment Managers & Superannuation (IMS) team.

ASIC has launched a seminar series for investment managers and superannuation industry representatives. 'ASIC Insights' will provide information about key issues and regulatory developments across these sectors and give attendees an opportunity to ask questions of senior staff from our Investment Managers & Superannuation (IMS) team.

The first 'ASIC Insights' seminar was held in September at ASIC offices across the country, and was well attended. A summary and video from this session is available on our website. Future sessions will be advertised on our website and in the Market Integrity Update.

'ASIC Insights' is one of a number of industry liaison activities undertaken by IMS. For example, IMS also conducts regular stakeholder engagement meetings with key industry associations and larger trustees and responsible entities, and presents at industry events.

ASIC cancels retail derivative issuer's licence

ASIC has cancelled the Australian financial service (AFS) licence of LSG Group Pty Ltd (LSG). LSG was authorised to provide financial product advice, deal in a financial product and make a market in derivatives products to retail and wholesale clients.

ASIC has cancelled the Australian financial service (AFS) licence of LSG Group Pty Ltd (LSG). LSG was authorised to provide financial product advice, deal in a financial product and make a market in derivatives products to retail and wholesale clients.

Following a hearing, an ASIC delegate found that LSG had:

- repeatedly failed to comply with the conditions of its AFS licence and the financial services laws, including failing to lodge financial statements, auditors reports, significant breach reports, failing to notify ASIC of changes in control of the AFS licensee and failing to lodge a Product Disclosure Statement (PDS) in-use notice

- made misleading or deceptive representations on its Australian and Chinese websites, and

- failed to do all things necessary to conduct financial services in an efficient, honest and fair manner in relation to a deposit of US$100,000 received from an overseas client.

ASIC Commissioner Greg Tanzer said 'Licensees will not be absolved of their obligations, including those relating to previous or ongoing breaches by a change in control or ownership. Any prospective new owners and managers should ensure they conduct adequate due diligence before acquiring a licence and assume responsibility of the licensees obligations.'

This work continues ASIC's focus on AFS licensee compliance in the retail OTC derivative sector, including margin foreign exchange, contracts for difference and binary options.

MECS: Tip of the month

Suspicious activity reporting

Lodging a suspicious activity report is quick and easy using Form M57 Suspicious activity reporting on MECS.

Lodging a suspicious activity report is quick and easy using Form M57 Suspicious activity reporting on MECS.

ASX, Chi-X and APX participants and crossing system operators must notify ASIC in writing if they suspect a person is engaging in market misconduct. To simplify this process, ASIC has designed a new form on MECS, which sets out what information to provide.

Suspicious activity reports are an important source of information about market misconduct for ASIC. To date, we have received 254 suspicious activity reports, and the rate at which these are being lodged is increasing.

ASIC has designed a poster to assist participants and crossing system operators to educate their employees about suspicious activity reporting. We encourage you to display it in high-visibility locations around your business, such as on trading desks, above the office photocopier or in your tearoom.

Participants who wish to can still submit suspicious activity reports by emailing markets@asic.gov.au.

ASIC markets articles now available on our website

ASIC regularly contributes articles on topical markets issues to industry publications. Until now, these articles have not been generally available, except to subscribers of those publications. This has now changed. We have established a catalogue of ASIC-authored markets articles on our website, which is accessible to everyone. We will regularly add articles to this webpage, and will alert readers to the availability of new content in the Market Integrity Update.

ASIC regularly contributes articles on topical markets issues to industry publications. Until now, these articles have not been generally available, except to subscribers of those publications. This has now changed. We have established a catalogue of ASIC-authored markets articles on our website, which is accessible to everyone. We will regularly add articles to this webpage, and will alert readers to the availability of new content in the Market Integrity Update.

Stories from the beat

The majority of market integrity outcomes ASIC achieves are not publicised in the media, but this does not detract from their importance. Every day, ASIC officers work to ensure our markets are fair and efficient. These are their stories

An ASIC officer reviewed a 'notice of meeting' outlining a company's intention to seek member approval for the issue and transfer of shares to a new controlling shareholder. The structure of the proposed transaction appeared to favour certain shareholders over the company, including some who had a family connection to one of the company's directors. Under the proposed transaction, those shareholders would be paid considerably more for their shares than the amount paid to the company for newly issued shares.

The ASIC officer made inquiries about the proposed transaction, including why an alternative arrangement was not pursued despite being more favourable to the company (which was in financial distress) and its shareholders as a whole. Following ASIC’s inquiries, the company advised us that it would restructure the proposed transaction to ensure that no group of shareholders was selectively advantaged.

|

92% of market participants and 100% of market operators pay their market supervision fees on time. |