Market Integrity Update - Issue 71 - May 2016

- March quarter equity market data

- Updated fundraising guidance discusses exposure periods

- MDA class order to be remade

- Confirmations for clients other than retail clients: Waiver extended

- Enforcement infographic

- Forward-looking statements about mining and resources

- MDP publishes details of two infringement notices

-

ASIC publishes articles on cyber resilience and communicating with stockbrokers

- Stories from the beat

March quarter equity market data

ASIC has published equity market data for the March quarter 2016.

ASIC has published equity market data for the March quarter 2016.

In summary, ASX accounted for 83.0% of the total dollar turnover in equity market products. Chi-X accounted for the remaining 17.0% of total dollar turnover. On-order book turnover (excluding ASX auctions) as a proportion of total dollar turnover increased to 68.3% in the March quarter 2016, compared to 67.3% in the December quarter 2015. Conversely, trade reporting turnover as a proportion of total dollar turnover decreased by 1.2 percentage points (ppts) to 16.7% over the quarter.

Overall daily turnover in the equity market averaged $5.7 billion in the March quarter 2016, a rise from $5.3 billion in the December quarter 2015.

Intraday and interday volatility remained at elevated levels, rising above the peak seen in August 2015. The weighted average interday volatility for the S&P/ASX 200 index was 2.1% for the quarter, up from 1.8% in the previous quarter.

The weighted average quoted bid–ask spread for securities increased marginally over the quarter. The overall order-to-trade ratio increased slightly to 8.3:1 in the quarter driven by increases on both Chi-X and ASX.

Below block size dark liquidity represented 11.6% of total value traded in the March quarter 2016. Turnover in block size dark liquidity was 12.5% of total value traded.

This data is available in table and graph format on our website.

Updated fundraising guidance discusses exposure periods

ASIC has updated its guidance on the steps involved in fundraising, including how we will administer the exposure period. Regulatory Guide 254 Offering securities under a disclosure document (RG 254) provides guidance on the process of preparing, lodging and offering securities under a disclosure document.

ASIC has updated its guidance on the steps involved in fundraising, including how we will administer the exposure period. Regulatory Guide 254 Offering securities under a disclosure document (RG 254) provides guidance on the process of preparing, lodging and offering securities under a disclosure document.

Generally, applications for non-quoted securities (e.g. in an initial public offering) offered under a prospectus must not be accepted until seven days after lodgement of the prospectus. This exposure period is intended to provide us and market participants with the opportunity to scrutinise disclosure documents before they are used for fundraising.

We may extend the exposure period for up to a further seven days in certain circumstances. For example, we recently extended the exposure period on a prospectus pending improvements in disclosure regarding the issuer’s description of its future plans and its basis for making certain forward-looking statements. RG 254 provides further guidance on the circumstances in which we will extend the exposure period, and our underlying policy for doing so.

In setting an offer timetable, issuers should carefully consider the potential for an exposure period to be extended. People dealing with an issuer should not draw any undue adverse implications from the extension of an exposure period.

Regulatory Guide 228 Prospectuses: Effective disclosure for retail investors (RG 228) continues to provide guidance on how to prepare prospectuses that satisfy the content requirements of the Corporations Act 2001 (Corporations Act).

MDA class order to be remade

Managed discretionary accounts (MDAs) are widely used in the stockbroking industry. We currently provide relief in Class Order [CO 04/194] Managed discretionary accounts to facilitate their use. This class order is due to expire on 1 October 2016. We intend to remake this class order with some variations before it expires.

Managed discretionary accounts (MDAs) are widely used in the stockbroking industry. We currently provide relief in Class Order [CO 04/194] Managed discretionary accounts to facilitate their use. This class order is due to expire on 1 October 2016. We intend to remake this class order with some variations before it expires.

[CO 04/194] provides relief from various obligations in the Corporations Act for MDA providers, custodians and advisers, provided they comply with conditions specified in the class order. Examples of relief provided under [CO 04/194] include relief from the obligation to register a managed investment scheme and provide certain product disclosures under the Corporations Act.

The remade class order will largely preserve the existing relief. Most of the variations were proposed by ASIC in Consultation Paper 200 Managed discretionary accounts: Updates to RG 179 (CP 200). CP 200 was published in 2013; however, implementation of the proposed changes was deferred to allow us to consider the implications of the Government's Financial Systems Inquiry and deregulatory agenda on MDA providers, among other reasons.

When the class order is remade we will provide suitable transition periods to ensure there is sufficient time for affected businesses to understand and put in place measures to comply with new requirements.

Confirmations for clients other than retail clients: Waiver extended

In October 2014, we granted a class waiver in respect of Rule 3.4.3(1)(b) of the ASIC Market Integrity Rules (ASX Market) 2010 for derivatives market contracts. We informed readers about this in Issue 51 of the Market Supervision Update. The application of this relief has now been extended until 30 June 2017.

In October 2014, we granted a class waiver in respect of Rule 3.4.3(1)(b) of the ASIC Market Integrity Rules (ASX Market) 2010 for derivatives market contracts. We informed readers about this in Issue 51 of the Market Supervision Update. The application of this relief has now been extended until 30 June 2017.

Rule 3.4.3(1)(b) imposes two disclosure requirements on ASX market participants:

- if a market participant entered into a client's transaction as principal, the participant must notify the client as soon as practicable that the participant entered into the transaction as principal, and

- if a client's market transaction was executed as a crossing, the participant must notify the client as soon as practicable of the execution code for the execution venue.

In some circumstances, both obligations will apply in which case both disclosures will be required.

Class Rule Waiver [CW 14/1091] was due to expire on 30 April 2016. It will now remain in effect until 30 June 2017. The extension will enable us to consult with industry and assess the impact of applying the obligation to derivatives market contracts.

If you have any questions about [CW 14/1091], please contact your ASIC relationship manager.

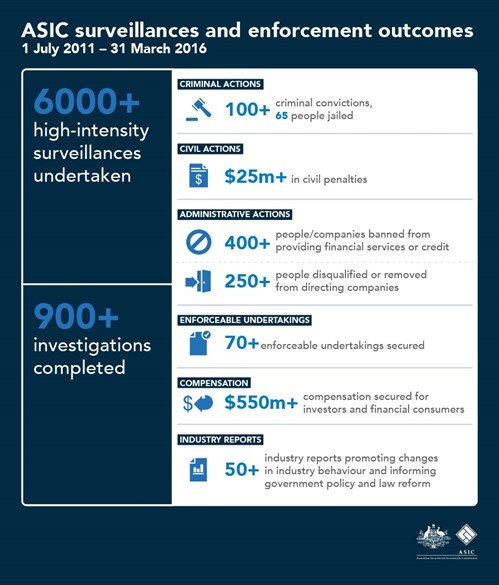

Enforcement infographic

We have released an infographic highlighting our surveillance and enforcement outcomes between May 2011 and March 2016.

Click on the infographic to view a full-sized PDF version (PDF 1 MB).

Publishing forward-looking statements

Investors in mining and resources companies often place a lot of emphasis on 'forward-looking statements' when considering an investment. In mining, these statements may include:

Investors in mining and resources companies often place a lot of emphasis on 'forward-looking statements' when considering an investment. In mining, these statements may include:

- production targets

- forecast financial information, and

- income-based discounted cash flow valuations.

Companies that publish forward-looking statements must ensure they comply with the relevant legal obligations and industry codes. Information Sheet 214 Mining and resources: Forward-looking statements (INFO 214) explains the requirements that apply to these statements and gives practical advice for complying with them.

In particular, INFO 214 describes the areas we focus on when assessing forward-looking statements. It also includes examples of cases where we have not been satisfied about the existence of reasonable grounds for a forward-looking statement, such as:

Insufficient consideration of the level of geographical knowledge and confidence of the underlying mineral resources

Example: The proportion of inferred mineral resources to indicated mineral resources is too high and does not comply with paragraph 8.5 of ASX Guidance Note 31.

Consideration of the JORC Code[1] modifying factors is insufficiently advanced

Example: Speculative assumptions are made about the mining, metallurgical and infrastructure modifying factors that are adequate to satisfy the JORC Code definition of a mineral resource but are not adequate to establish reasonable grounds under the legal requirements.

MDP publishes details of two infringement notices

Deutsche Bank AG pays $20,000 penalty

Deutsche Bank Aktiengesellschaft (Deutsche Bank AG) has paid a penalty of $20,000 to comply with an infringement notice given to it by the Markets Disciplinary Panel (MDP).

Deutsche Bank Aktiengesellschaft (Deutsche Bank AG) has paid a penalty of $20,000 to comply with an infringement notice given to it by the Markets Disciplinary Panel (MDP).

The penalty was for failing to make the necessary inquiry through the message facility of the ASX 24 market and wait the prescribed period before entering orders for execution onto its trading platform, as required by the relevant market integrity rule.

In determining the matter and the appropriate penalty to be applied, the MDP noted the misconduct:

- reduced the transparency of the market by not providing pre-trade information on the opposing orders which transacted in the relevant trade, and

- had the potential to damage the reputation and integrity of the market for the relevant security because it impacted the fairness of the market, by preventing others from participating in the relevant trade.

ABN AMRO pays $45,000 penalty

ABN AMRO Clearing Sydney Pty Ltd (ABN AMRO) has paid a penalty of $45,000 to comply with an infringement notice given to it by the MDP

The penalty was for failing to make the necessary inquiries through the message facility of the ASX 24 market and wait the prescribed period before entering orders for execution onto its trading platform as required by the relevant market integrity rule.

In determining the matter and the appropriate penalty to be applied, the MDP noted the contraventions:

- potentially reduced the transparency of the markets for the relevant security by not providing pre-trade information on the opposing orders which transacted in the relevant trades, and

- also had the potential to damage the reputation and integrity of the markets for the relevant security because it impacted the fairness of the market, by preventing others from participating in the relevant trades.

Important regulatory information

Pursuant to regulation 7.2A.15(4)(b)(i)–(ii) of the Corporations Regulations 2001, the parties named above have complied with the infringement notice. Compliance is not an admission of guilt or liability, and is not taken to have contravened section 798H(1) of the Corporations Act.

ASIC publishes articles on cyber resilience and communicating with stockbrokers

We have published an article discussing the importance of cyber resilience in the financial services industry. The article lists questions we think board members should ask their senior leadership team to ensure cyber resilience is embedded within their organisation.

We have published an article discussing the importance of cyber resilience in the financial services industry. The article lists questions we think board members should ask their senior leadership team to ensure cyber resilience is embedded within their organisation.

We have also published an article describing our efforts to improve communications with the stockbroking industry. The main change is greater choice, in particular, about how you receive information and what you can do with it. This is part of our commitment to regulating for real people.

Stories from the beat

The majority of the market integrity outcomes we achieve are not reported by the media, but this does not detract from their importance. Every day, ASIC officers work hard to ensure our markets are fair, orderly and transparent. These are their stories.

The majority of the market integrity outcomes we achieve are not reported by the media, but this does not detract from their importance. Every day, ASIC officers work hard to ensure our markets are fair, orderly and transparent. These are their stories.

A technology provider upgraded its automated order processing (AOP) production server. The provider issued a general circular to its customers regarding the changes, but did not contact them individually. As a result, one market participant was unaware of the impact of the changes and did not make consequential adjustments to its AOP environment. An erroneous order was subsequently placed into the market.

The participant notified ASIC of this incident (and instigated remedial actions to prevent a reoccurrence). After reviewing the facts, it was apparent to ASIC that the participant did not have organisational and technical resources in place, including appropriate automated filters, filter parameters and processes to record any changes to the filters or filter parameters.

We are aware of other instances where participants were not aware of the effect of upgrades by technology providers on their own systems and ability to comply with the ASIC market integrity rules.

Participants are responsible for ensuring the suitability of functions provided by third parties. This includes technology provided by key vendors.

Participants should discuss with their technology providers the process for receiving information about, and the impact of, software or system changes, and the approval process for implementing changes. They should periodically remind technology providers of the importance of this requirement. Participants must ensure they understand the nature and impact of any changes before they occur.

[1] The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code).